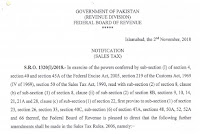

FBR TO AUDIT SALES TAX REFUNDS LAST 4 YEARS: S.R.O. 1320(1)/2018 dated November 2, 2018

FEDERAL BOARD OF REVENUE

*****

Islamabad, the 2nd November, 2018

NOTIFICATION

(SALES TAX)

S.R.O. 1320(1)/2018.- In exercise of the powers conferred by sub-section (I) of section 4, section 40 and section 45A of the Federal Excise Act, 2005, section 219 of the Customs Act, 1969 (IV of 1969), section 50 of the Sales Tax Act, 1990, read with sub-section (2) of section 8, clause (b) of sub-section (1) of section 8, clause (ii) of sub-section (2) of section 8B, sections 9, 10, 14, 21, 21A and 28, clause (c) of sub-section (1) of section 22, first proviso to sub-section (1) of section 23, section 26, section 33, section 40C, sub-section (6) of section 47A, sections 48, 50A, 52, 52A and 66 thereof, the Federal Board of Revenue is pleased to direct that the following further amendments shall be made in the Sales Tax Rules, 2006, namely:—

In the aforesaid Rules,—

(a) 'in rule 26A, in sub-rule (8), for the second proviso, the following shall be substituted, namely:—

"Provided further that where the Commissioner Inland Revenue has reason to believe, on the basis of some information, pre-determined criteria or otherwise, that a registered person, whose refund claim was processed or sanctioned after the 30th June, 2014, has been paid refund which was not admissible, he may direct through order in writing to conduct manual post-refund scrutiny of such claim."; and

(b) in rule 36, in sub-rule (1), for second proviso, the following shall be substituted, namely:—

"Provided further that where the Commissioner Inland Revenue has reason to believe, on the basis of some information, pre-determined criteria or otherwise,

Very good write-up. I certainly love this website. Thanks! Zeeshan Haider There's definately a lot to know about this issue. Muhammad Zeeshan Haider I really like all the points you made.

ReplyDeleteWe are loving this blog as this seems to be written by a professional with professional ideas and the intent to share authentic information and help people in their respective fields. Regards: online fbr integrationYou should write more articles like this to help people. We truly loved it.

ReplyDelete