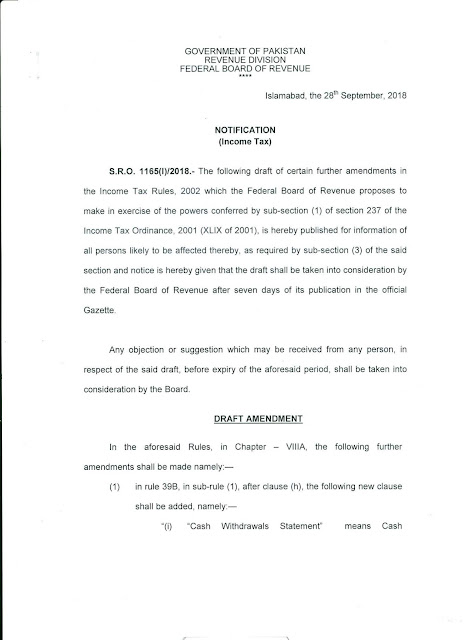

S.R.O. 1165(1)12018: Banks asked to provide information of persons withdrawing cash above Rs. 50,000/-

GOVERNMENT OF PAKISTAN REVENUE DIVISION FEDERAL BOARD OF REVENUE Islamabad, the 28th September, 2018 NOTIFICATION (Income Tax) S.R.O. 1165(1)/2018 The following draft of certain further amendments in the income Tax Rules, 2002 which the Federal Board of Revenue proposes to make in exercise of the powers conferred by sub-section (1) of section 237 of the Income Tax Ordinance, 2001 (XLIX of 2001), is hereby published for information of all persons likely to be affected thereby, as required by sub-section (3) of the said section and notice is hereby given that the draft shall be taken into consideration by the Federal Board of Revenue after seven days of its publication in the official Gazette. Any objection or suggestion which may be received from any person, in respect of the said draft, before expiry of the aforesaid period, shall be taken into consideration by the Board. DRAFT AMENDMENT In the aforesaid Rules, in Chapter – VIIIA, the following further amendm