LHC ruling: IR commissioners can neither issue show-cause, nor assessment order

"....The Lahore High Court has held that deputy commissioner and assistant commissioner of Inland Revenue can neither issue show-cause notice under section 11 of the Sales Tax Act, 1990 nor pass assessment order against the taxpayers. According to a judgment of the LHC, the FBR has delegated jurisdiction to the commissioner only and the commissioner cannot further delegate his jurisdiction to the deputy commissioners and assistant commissioners....."

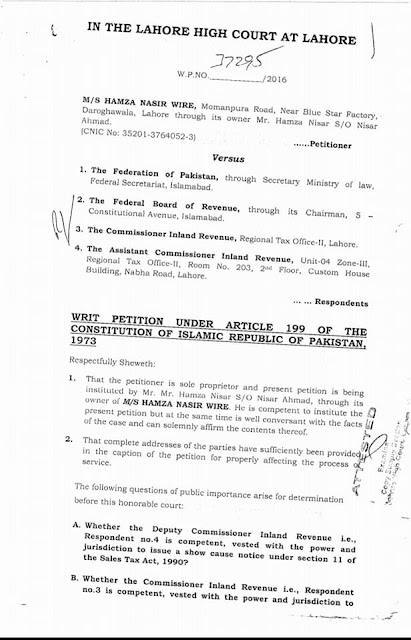

"....The background facts are that a number of writ petitions were filed before the Lahore High Court challenging that the show cause notices issued under section 11 of the Sales Tax Act, 1990 by the sales tax authorities other than commissioner Inland Revenue are without jurisdiction. It was pleaded that FBR in exercise of its power under section 30 of the Sales Tax Act, 1990 had issued jurisdiction order assigning jurisdiction over the case of petitioners to the commissioner Inland Revenue Lahore and in turn the commissioner issued his own jurisdiction order and assigned the jurisdiction/ function to various deputy commissioners and assistant commissioners subordinate to him and this further delegation is prohibited as per restrictions contained in section 32(3) which provides that the officer to whom any powers are delegated under this section shall not delegate such powers....."

IR commissioners can neither issue show-cause, nor assessment order Section 11 of the Sales Tax Act, 1990

Following is the copy of the order:

Comments

Post a Comment