Understanding provisions of withholding taxes under the Income Tax Ordinance, 2001

1. Introduction:

1.1) Provisions of withholding taxes are probably one of the most efficient methods of tax collection at source or in advance as the case may be implemented by the tax authorities.

1.2) There are three following major benefits of implementation of withholding taxes:

- Taxes are deposited in government treasury at the time of transaction (Div III Part V Chapter X)

- Taxes are deposited in government treasury advance (Div I & II Part V Chapter X, Chapter XII)

- The responsibility of tax collection is transferred to the withholding agents instead of tax department

1.3) There are effectively following types of withholding taxes:

- Sales tax withholding procedures (please refer to my previous post https://zeeshanqureshi.blogspot.com/2017/11/overview-of-sales-tax-withholding.html)

- Income Tax withholding from salary under section 149 of the Income Tax Ordinance, 2001

- Income tax withholding other than salary

1.4) In the following blog we will discuss in detail the procedures regarding withholding taxes laid down under the Income Tax Ordinance, 2001.

1.5) Withholding taxes can be explained as retention taxes in which certain persons prescribed as withholding agents are bound to deduct a portion of tax from the suppliers or employees salaries at the time of payment and are supposed to deposit the tax deducted within a certain time as specified in the Government treasury.

1.6) As per clause 7 of section 153 of the Income Tax Ordinance 2001 following persons are prescribed as withholding agents:

- The Federal Government;

- a company;

- an association of persons constituted by or under law;

- a non-profit organisation;

- a foreign contractor or consultant;

- a Consortium or joint venture;

- an exporter or an export house for the purpose of sub section 2 of section 153;

- an association of persons having turnover of 50 million rupees or above in tax year 2007 or in any subsequent year;

- an individual having turnover of 50 milion rupees or above in the tax year 2009 or in any subsequent year; or

- a person registered under the Sales Tax Act, 1990

1.7) The following entities are required to deduct tax on account of payment of rent under section 155:

- a charitable institution,

- a private educational institution,

- a boutique,

- a beauty parlour,

- a hospital,

- a clinic,

- a maternity home, or

- individuals or association of persons paying gross rent of Rs.1.5 million and above in a year.

2. Procedure of Withholding Taxes:

2.1) The withholding agent as prescribed must after deduction of tax shall initially create a PSID for the submission of the tax deducted in to the Government treasury through the web portal of FBR and once the payment is cleared the PSID will thereon be converted to CPR.

Format of PSID

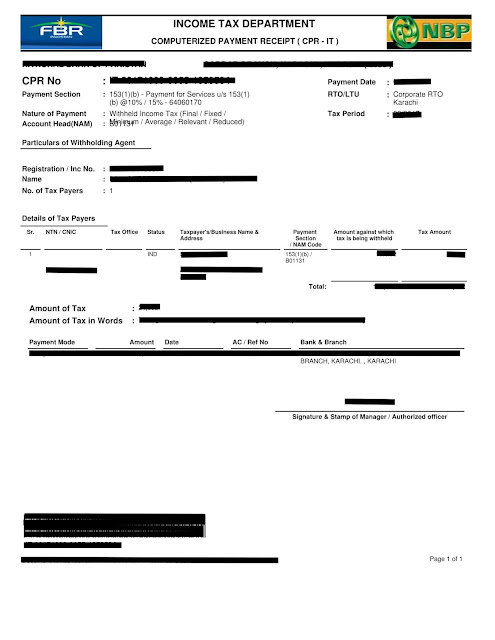

Format of CPR

2.2) Every withholding agent shall at the time of collection of deduction of tax furnish a certificate of tax deduction under section 164 of the Income Tax Ordinance 2001 as per rule 42 of the Income Tax Rules, 2002 to the supplier along with copies of challan of payment so that the supplier or the employee may adjust the tax deducted in his annual tax return as advance taxes

2.3) Following is the format of tax deduction certificate to be issued by the withholding agents:

2.4) Once the withholding agent has deducted the taxes at source he is required to file monthly statements under section 149 (for salary) and 165 (other than salary) of the Income Tax Ordinance, 2001

2.5) This statement shall consist of the following:

- Acknowledgement of the monthly statements submitted; and

- Monthly statement in detail consisting of individual line items containing Name, Address, Amount, Tax rate, Tax e.t.c.

2.6) The above mentioned monthly statements of withholding taxes shall be submitted on every 15th of the subsequent month.

3. MONITORING OF WITHHOLDING TAXES

3.1) Once the process of withholding is completed by the withholding agent the proceedings under section 176 of the Income Tax Ordinance 2001 in respect of monitoring of withholding taxes paid or deducted may then be initiated by the department every year.

3.2) The purpose of the said proceedings is to monitor deduction of withholding taxes and its timely deposit into the federal treasury according to the prescribed manner with respect to purchases payments expenses made during the said period

3.3) These proceedings may required submission detail reply along with of following documents:

- Audited accounts

- Annual monthly statement submitted on the web portal of FBR

- Copies of invoices vouchers etc

- Cash book

- Party wise ledger

- Copies of bank statements

- Copies of exemption certificate in case the party was exempted from the deduction of taxes at source

- Copies of paid challan

- Payroll on salary register

- A reconciliation of payments with the expenses in accordance with sub rule 4 off rule 44 of the Income Tax rules 2002

3.4) For a sample reply to the proceedings initiated regarding monitoring of withholding taxes please refer following link https://zeeshanqureshi.blogspot.com/2017/10/monitoring-of-withholding-taxes-sample.html

4. Adjustment of withholding taxes against advance tax under section 147 of the Income Tax Ordinance, 2001

4.1) The deductions at sources under various provision of the Income Tax Ordinance 2001 can be adjusted against the quarterly payment of Advance Taxes as prescribed under the section 147 of the Income Tax Ordinance 2001.

4.2) A sample format for adjusting the said deduction at source is is prescribed as follows for an easy understanding:

5. SRO 586/91 of 1991

5.1 As per the above SRO persons receiving payments, for the supply of goods or execution of a contract, not exceeding rupees one thousand for a single transaction and the total of such transactions does not exceed rupees ten thousand in a financial year:

5.2 Provided that where the total value of payments, on accounts of the aforesaid transactions, exceeds rupees ten thousand during a financial year, the payer shall deduct tax from the payments including the tax on payments of rupees one thousand or less made earlier without deduction of tax during the same financial year.

This is great tax planning Texas advice for any tax audit firm who are doing taxation business.

ReplyDeleteFabulous post, you have denoted out some fantastic points, I likewise think this s a very wonderful website. I will visit again for more quality contents and also, recommend this site to all. Thanks. llc tax calculator

ReplyDeleteThanks for sharing this information. I really like your blog post very much. You have really shared a informative and interesting blog post with people.. estimate business taxes

ReplyDeleteGood article! I see your points as being valid and I appreciate the way you expressed yourself in this material. This is really excellent content. If you are looking for the best tax advisor in Croydon, Taxaccolega Chatered Accountants & Taxation Advisors is here to assist you in Surrey and London.

ReplyDeleteThis is just the information I am finding everywhere. Thanks for your blog, I just subscribe your blog. This is a nice blog.. likvideerimine

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks for Sharing such imported information with us. I hope you will share some more info about us. please keep sharing!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteImpressive piece! Your viewpoints are well-founded, and your articulation is commendable. This truly outstanding content resonates with me. For an exceptional auction experience, mark your calendars for the

ReplyDeleteImpressive piece! Your viewpoints are well-founded, and your articulation is commendable. This truly outstanding content resonates with me. For an exceptional auction experience, mark your calendars for the Anwar Khan Auction.

ReplyDeleteI must say, your eloquence shines through brilliantly in this discussion. Your insights are both perceptive and well-expressed, making for a truly enlightening read. Your enthusiasm for the upcoming Anwar Khan Auction is palpable, and I couldn't agree more – it's bound to be an event to remember.

ReplyDeleteFor anyone in need of ground rent collection services, MW Property Service is the go-to option. They provide a seamless experience, handling everything from invoicing to chasing overdue payments. Their attention to detail and customer-first approach make them stand out in the property management industry.

ReplyDeleteI found Digiliance while researching p tax in assam and I’m sticking with it. Their site is professional, trustworthy, and makes payroll compliance much easier for my team.

ReplyDelete