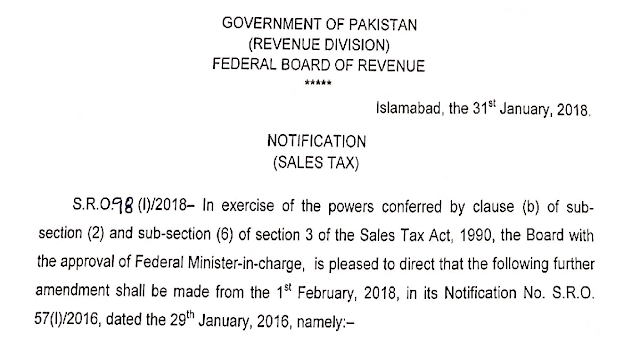

SRO 98(I)/2018 DATED JANUARY 31, 2018 - Change in sales tax rates on petroleum products with effect from 1st February 2018

GOVERNMENT OF PAKISTAN (REVENUE DIVISION) FEDERAL BOARD OF REVENUE Islamabad, the 31st January, 2018. NOTIFICATION (SALES TAX) S.R.O. 98 (1)12018- In exercise of the powers conferred by clause (b) of sub-section (2) and sub-section (6) of section 3 of the Sales Tax Act, 1990, the Board with the approval of Federal Minister-in-charge, is pleased to direct that the following further amendment shall be made from the 1st February, 2018, in its Notification No. S.R.O. 57(1)12016, dated the 29th January, 2016, namely:- In the aforesaid Notification, for the existing Table, the following shall be substituted, namely:- For pdf Click Here